In recent discourse, the focus on the Federal Reserve’s lavish renovations has ignited a debate that goes beyond mere budgetary concerns—highlighting a deeper issue about accountability, transparency, and the subtle erosion of institutional integrity under political influence. The fervor surrounding the alleged $2.5 billion project is, on the surface, a reflection of fiscal prudence or mismanagement; however, beneath this spectacle lies a troubling narrative about the intentional blurring of lines between independent governance and politicized manipulation. It is a stark reminder that when oversight becomes intertwined with political agendas, the public’s trust in institutions deteriorates, and the foundations of responsible policymaking are compromised.

Rather than viewing the renovation controversy as a straightforward mismanagement issue, it’s essential to recognize it as a symptom of systemic vulnerabilities rooted in the weakening of checks-and-balances. Claims that the Fed’s renovations resemble a “palace,” as allegedly excessive and wasteful, serve a dual purpose: fueling political narratives aimed at discrediting the institution’s independence and distracting from more consequential issues such as policy decisions impacting millions through interest rate manipulations. The tendency to scapegoat the Fed underpins a broader strategy to influence monetary policy, catering to short-term political gains rather than long-term economic stability.

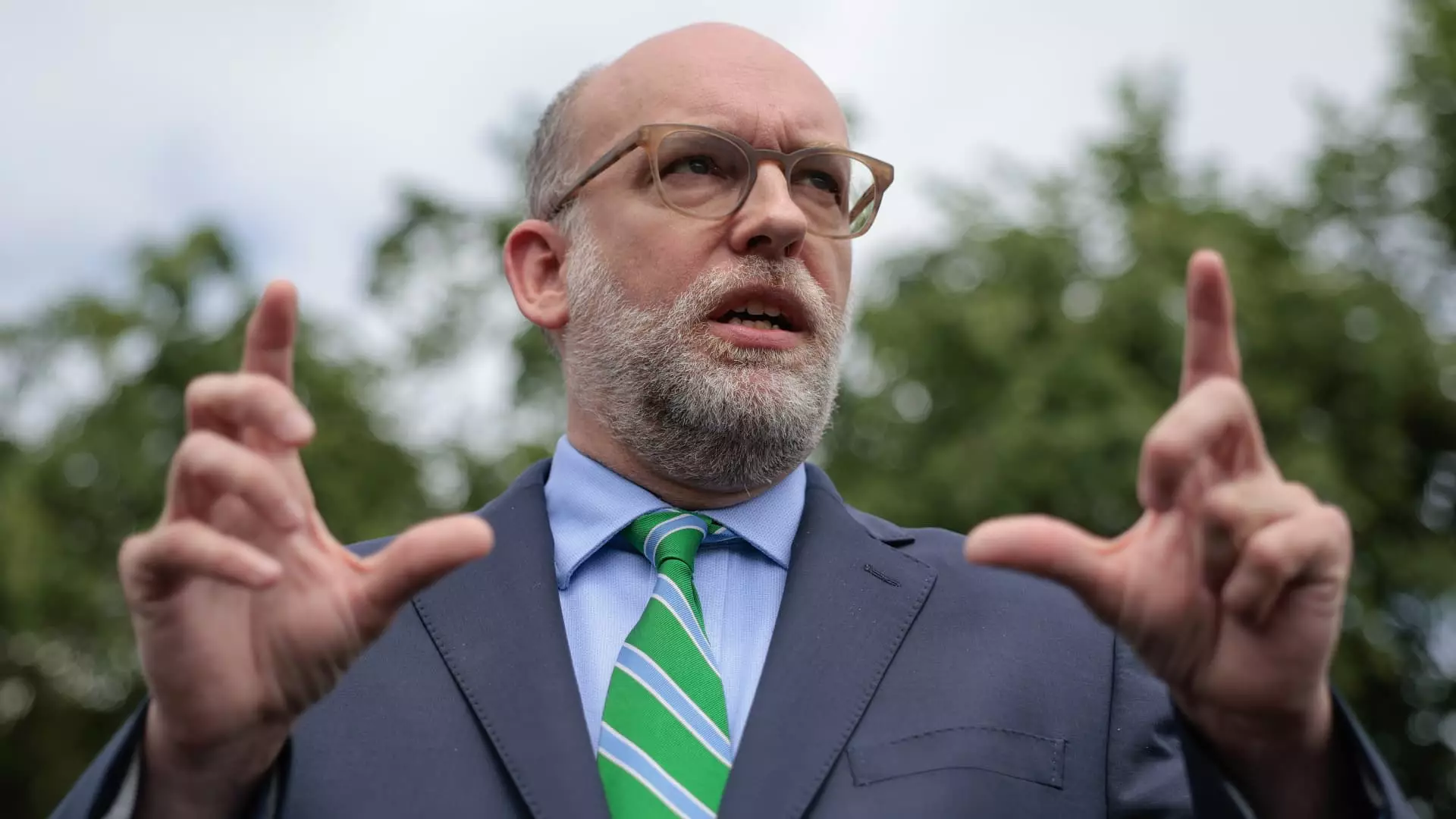

This atmosphere of suspicion is compounded by figures like Russell Vought, who weaponize oversight claims to serve political ends, rather than genuine fiscal discipline. Invoking security and mismanagement becomes a convenient pretext for undermining an autonomous institution that, despite its flaws, remains a cornerstone of economic stability. The way in which the narrative frames the Fed’s inner workings—portraying it as an opaque, bloated bureaucracy—ignores the nuanced complexities involved in managing a central bank. Instead, it promotes a simplified antagonist that feeds into populist discontent, fostering distrust in expert-led governance.

The Power Dynamics Behind the Curtain

Behind the scenes, the political machinations become even more evident. The recent appointments of individuals with explicit ties to the White House and Office of Management and Budget exemplify how power brokers seek to influence the Federal Reserve from within. By stacking the board with politically aligned figures, the ultimate goal is not merely oversight but control—ushering in a form of covert influence that threatens the very independence the Fed was designed to uphold. These moves underscore a disturbing trend: central banking decisions, particularly interest rate adjustments, are increasingly seen through a political lens, undermining their credibility and exacerbating market volatility.

Moreover, the accusations about mismanagement of funds at the Fed are not isolated incidents—they are part of a broader narrative constructed to justify interventions and potentially press for the resignation of Chairman Jerome Powell. The ongoing debate about whether the Fed’s rate decisions are politically motivated ignores the reality that, regardless of political interference, the institution faces an existential challenge: balancing independence with the need to remain accountable to the democratic process. When political actors leverage accusations of wastefulness and mismanagement, they risk eroding the very autonomy necessary for a central bank to fulfill its mandate effectively.

The narrative also reveals a deeper ideological struggle—between those who prioritize financial oversight and those who see it as a pretext for political oversight. When the public perceives the Fed as both a bureaucratic maze and a political pawn, the legitimacy of monetary policy becomes ensnared in partisan disputes. This climate diminishes the capacity for pragmatic policymaking, leaving markets vulnerable to unpredictable swings driven by rhetoric rather than data.

The Illusion of Control and the Cost of Distracted Governance

The controversy over the Fed’s renovations is emblematic of a larger problem: the tendency to sensationalize legitimate concerns into politically charged accusations that divert attention from critical economic issues. While legitimate oversight should indeed scrutinize governmental and quasi-governmental spending, it must do so through an informed, objective lens—free from manipulative agendas that exploit public sentiments. When political actors frame institutional spending as emblematic of systemic mismanagement, it risks turning complex governance into a battleground for partisan warfare.

Furthermore, this spectacle diverts scrutiny from withering structural issues—such as rising debt levels, inflationary pressures, and the central bank’s own blunders—that have more profound implications for economic stability. The focus on bucolic renovations obscures the fact that monetary policy decisions, interest rate strategies, and fiscal responsibilities shape the fabric of everyday life for millions. Spectacular accusations about a “palace” are mere distractions when the real threats are the opaque decision-making processes and the politicization of independence that undermine trust in economic institutions.

The debate over the Fed’s renovations also inadvertently reveals an ideological bifurcation—some actors see the central bank as a tool for political ends, while others push for a return to responsible, transparent governance rooted in expertise. True accountability does not stem from theatrical investigations or branding the Fed as a symbol of excess; it requires a recalibration of how institutions are held to standards, emphasizing transparency, independent oversight, and resistance to partisan intrusion.

By allowing political narratives to dominate discourse, society risks reducing the central bank’s role to a pawn in broader ideological battles. This diminishes the capacity for effective economic management, fueling instability and eroding the trust of the very citizens governments are meant to serve. Instead of fostering a space for critical but constructive engagement, the current trajectory risks transforming oversight into a political weapon that ultimately damages the legitimacy of all involved parties.