The nomination of former Missouri congressman Billy Long to lead the Internal Revenue Service (IRS) under President-elect Donald Trump has ignited a fiery debate among lawmakers and the tax community. As discussions unfold, it becomes evident that this appointment might represent both a potential shift in policy and deep-seated concerns about the future direction of the agency.

With Billy Long as a potential IRS head, there are implications for the agency’s multibillion-dollar overhaul aimed at modernizing its operations and improving customer service. The IRS has recently focused on not just enhancing technology but also rolling out free filing options and ramping up efforts to go after tax evaders—particularly wealthy individuals and large corporations. The agency has seen an influx of nearly $80 billion in funding from Congress, which has generated controversy, particularly among Republicans who criticize the usage of these funds under the upcoming administration.

Long’s nomination raises questions about how this funding will be allocated moving forward. If he is confirmed, will the investments in taxpayer services and enforcement of tax compliance continue, or will there be a pivot towards different priorities? This uncertainty looms large over Long’s potential leadership, especially considering the stark political differences characterizing Congress today.

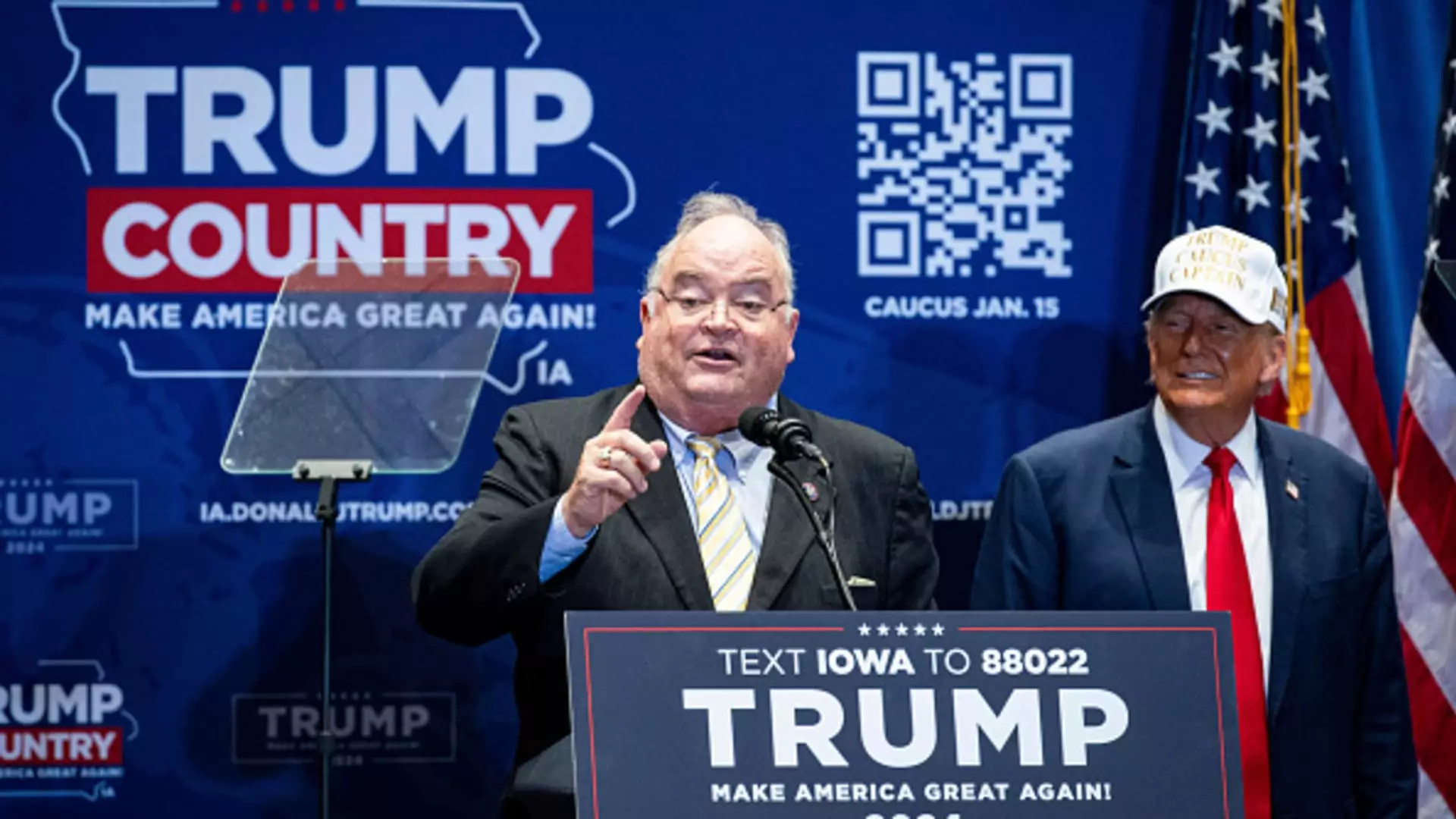

In his announcement, President Trump highlighted Long’s background as a business and tax adviser, searching for ways to simplify IRS rules for small businesses. While an auctioneer by trade, Long’s experience in Congress—served over six terms—could arguably lend credibility in navigating legislative waters. In this sense, Long might be in a favorable position to advocate for the independence of the IRS, an agency often seen as vulnerable to political pressures.

Supporters of Long echo sentiments that his congressional tenure may position him favorably with lawmakers. Mark Everson, a former IRS commissioner, remarked on the unconventional nature of Long’s selection compared to his predecessors. There is hope that Long, leaning into his political background, could foster necessary relationships in Congress that benefit the IRS in the long term.

However, the selection has not been devoid of criticism. Democratic senators have voiced their concerns regarding Long’s involvement in controversial practices linked to the Employee Retention Tax Credit (ERTC). Critics argue that Long’s transition from Congress into the ERTC realm—an area rife with scams and improper claims—casts doubt on his credibility as a leader capable of instilling trust in the IRS.

Senator Ron Wyden has been particularly vocal, denouncing Long as a peculiar choice for the role. The apprehension surrounding Long’s potential inability to navigate the complexities of the IRS responsibly cannot be overstated. As the landscape of federal taxation grows increasingly intricate, questions remain as to whether Long is equipped for the challenges at hand.

The nomination of Long represents a significant inflection point for the IRS. Should he be confirmed, it may usher in new priorities, potentially sidelining technological advancements and accountability measures designed to protect taxpayer information. As noted by GOP Senator Mike Crapo, the IRS has faced a myriad of challenges—including ensuring the privacy and security of taxpayer data—which would require significant attention from the new appointee.

Long’s vision for the future of the IRS, if he assumes the role, will likely hinge on his approach to these critical issues. The conciliation between prioritized enforcement and the rights and protections of the average taxpayer may prove vital in determining the agency’s trajectory moving forward.

As the confirmation process unfolds, the public’s response is growing increasingly polarized. The ramifications of Long’s potential leadership are yet to be seen, but the nomination undeniably highlights the necessity for collaboration and vigilance in an agency tasked with handling America’s tax affairs. While change can often be a catalyst for improvement, it also holds the potential for unforeseen pitfalls, which many are wary to embrace as the IRS stands on the precipice of potentially transformative leadership.