Nvidia recently made headlines as its shares crossed the $1,000 mark for the first time in extended trading following a robust fiscal first-quarter earnings report. The company exceeded analyst estimates on both earnings per share and revenue, a testament to the strength of the AI boom that has captivated markets in recent months. This milestone is significant not only for Nvidia but also for the tech industry as a whole.

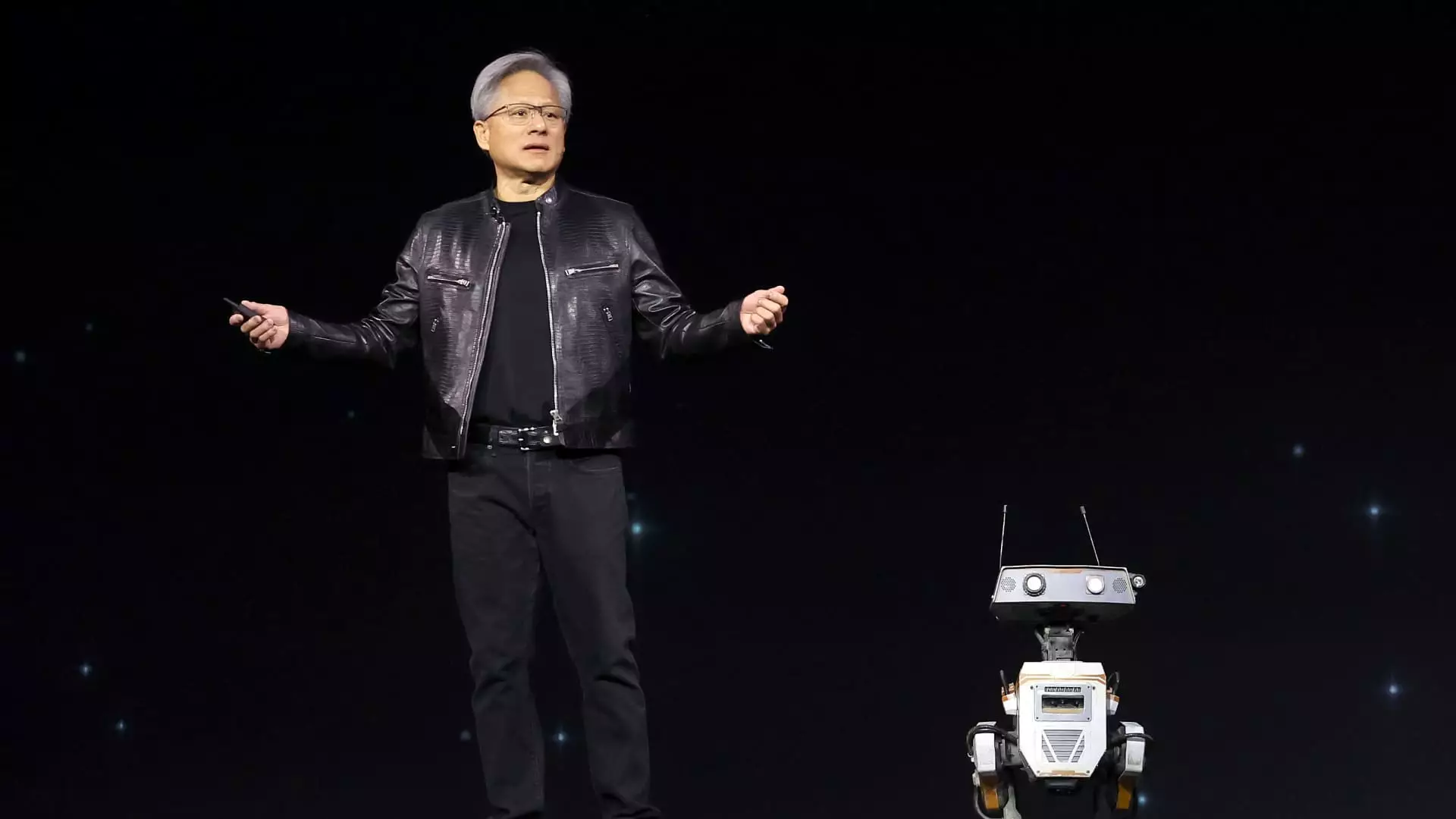

Nvidia’s quarterly report serves as a barometer for the demand for AI chips, a key component in the development and deployment of artificial intelligence applications. The fact that the company’s earnings exceeded expectations indicates that the demand for the AI chips remains strong, boding well for Nvidia’s future growth prospects. Additionally, CEO Jensen Huang’s announcement of the upcoming release of the next-generation AI chip, named Blackwell, later this year further reinforces Nvidia’s position as a leader in the industry.

The stock market responded positively to Nvidia’s earnings report, with the company’s stock rising 7% in extended trading. Furthermore, Nvidia’s announcement of a 10-to-1 stock split suggests that the company is confident in its continued growth and is taking steps to make its shares more accessible to a wider range of investors. With the shares poised to reach a fresh high, investors are optimistic about Nvidia’s future performance.

Nvidia’s success can be attributed to its strategic diversification across multiple business segments. While the company is best known for its data center sales, which include AI chips and related components, Nvidia has also seen strong growth in other areas such as gaming, networking, and automotive sales. The company’s ability to cater to a diverse set of customers and industries has been a key driver of its revenue growth in recent quarters.

One of the highlights of Nvidia’s earnings report was the significant increase in data center revenue, which rose 427% year-over-year to $22.6 billion. This growth was fueled by strong demand for the company’s Hopper graphics processors, such as the H100 GPU, which are essential for running large AI servers. Nvidia’s success in the data center segment is further underscored by its partnership with major cloud providers, who account for a significant portion of the company’s data center revenue.

Looking ahead, Nvidia is well-positioned to capitalize on the continued growth of the AI industry. The upcoming release of the Blackwell AI chip, along with strong demand for networking products and gaming chips, is expected to drive further revenue growth for the company. Nvidia’s commitment to innovation and its ability to adapt to changing market conditions will be key factors in determining its future success.

Nvidia’s record-breaking earnings report underscores the company’s position as a leader in the tech industry. By exceeding analyst estimates and announcing new product launches, Nvidia has demonstrated its ability to stay ahead of the curve and meet the evolving needs of its customers. As investors and industry observers await the next chapter in Nvidia’s growth story, one thing is certain – the company’s future is looking brighter than ever.