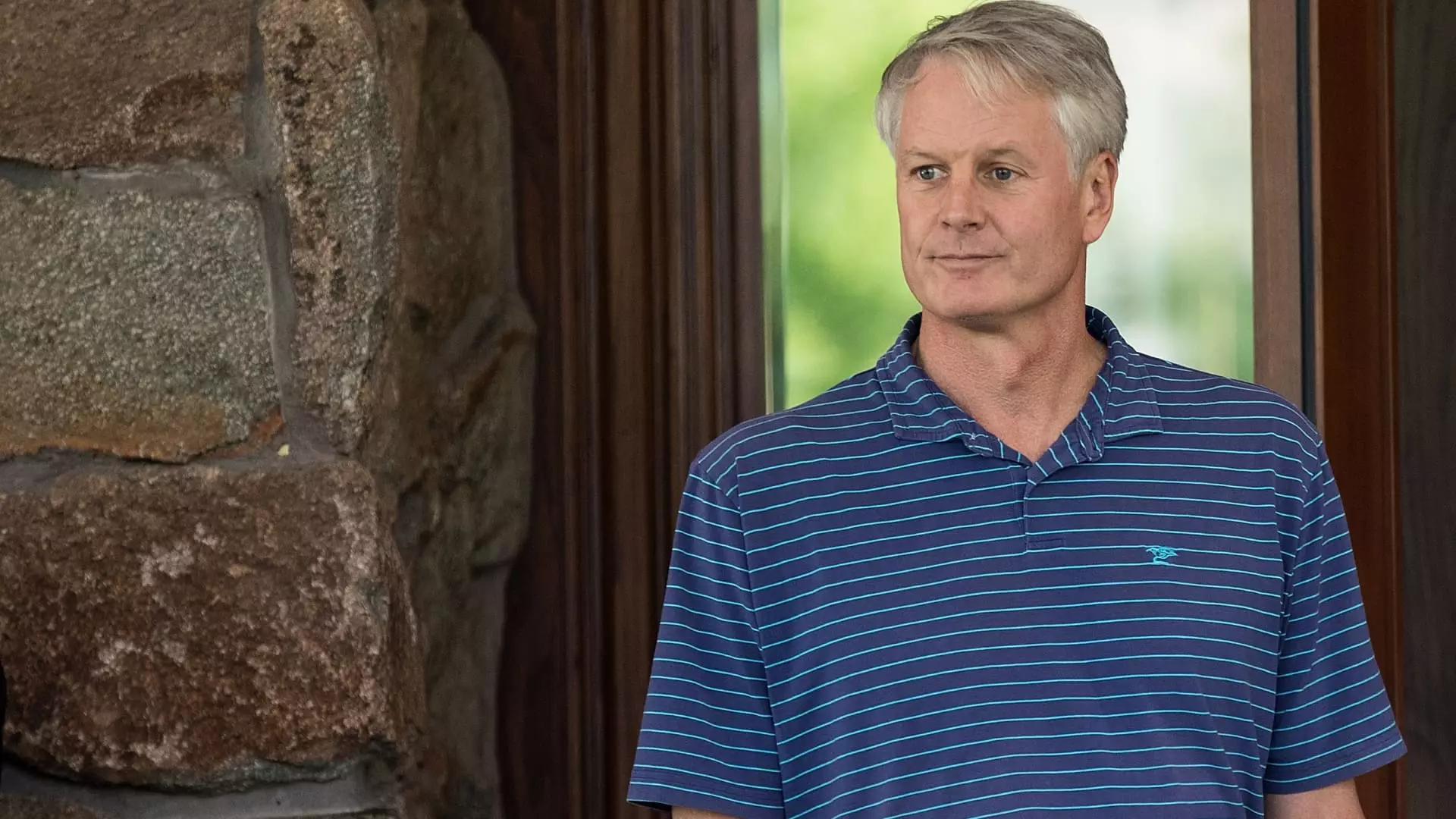

The CEO of Nike, John Donahoe, is currently facing a crisis of confidence on Wall Street. After delivering a lackluster fiscal year, Nike announced that sales in the current quarter were projected to decline by 10%. This dismal outlook was far worse than the 3.2% drop that LSEG had anticipated. With the slowest annual sales gain in 14 years, excluding the impact of the Covid-19 pandemic, Nike also revised its sales expectations for fiscal 2025 to show a decline in mid-single digits, a significant deviation from the prior growth projections. Consequently, Nike’s stock plummeted by 20% following the quarterly report, leading to a market value of around $114 billion.

Stock Performance Under Donahoe’s Leadership

During John Donahoe’s tenure as Nike’s CEO, the company’s stock has underperformed the S&P 500 by approximately 25%. This disappointing performance stands in stark contrast to the gains of around 69% and 67% seen in the S&P 500 and retail-focused ETF XRT, respectively, during the same period. Nike’s finance chief, Matt Friend, indicated that the guidance cut was influenced by various factors, including challenges in China, foreign exchange headwinds, and strategic decisions made under Donahoe’s leadership that have hindered the company’s growth.

Nike’s struggle to maintain growth and customer engagement can be attributed to several missteps under Donahoe’s watch. As the company focused on scaling new styles and direct-selling strategies, it neglected to address changing consumer preferences and innovate its product offerings. This failure was evident in declining sales of core franchises like Air Force 1s, Air Jordan 1s, and Dunks, which have lost appeal among customers seeking fresh and innovative designs from competitors. Running enthusiasts, a crucial customer segment, also shifted their loyalty to emerging brands like On Running and Hoka that offered superior and more relevant products.

Analysts and investors have raised concerns about Nike’s management credibility and the need for a change in leadership. Several investment banks have downgraded Nike’s stock, with prominent analysts questioning the company’s direction and execution under Donahoe. While some acknowledge the challenges posed by the Covid-19 pandemic, others believe that management missteps and failures to adapt to market shifts have significantly impacted Nike’s performance. Calls for a change in leadership have intensified, with experts suggesting that Donahoe’s employment contract may soon expire, paving the way for new leadership to steer the company in a different direction.

Despite growing concerns about John Donahoe’s leadership, Nike’s founder and chairman emeritus, Phil Knight, remains optimistic about the company’s future. Knight expressed confidence in Nike’s plans and reiterated his support for Donahoe’s strategies. However, the discrepancy between Wall Street’s sentiments and Knight’s endorsement highlights the internal and external challenges facing Nike under its current leadership. As the company navigates through a turbulent period marked by declining sales and heightened competition, the need for decisive leadership and strategic vision becomes increasingly evident.

Overall, the crisis surrounding Nike’s CEO, John Donahoe, underscores the delicate balance between executive leadership, corporate strategy, and market dynamics. While the company has experienced growth during Donahoe’s tenure, concerns about its long-term sustainability and competitive positioning have eroded investor confidence and sparked calls for a change in management. As Nike charts its course forward, the decisions made in the boardroom and on the ground will determine its ability to regain momentum, recapture market share, and restore trust among stakeholders.