The journey of Nvidia over the recent financial episodes exhibits a remarkable yet tumultuous relationship with its investors, reflecting the broader dynamic of the flourishing artificial intelligence (AI) landscape. Following two years of euphoric gains where the chipmaker experienced an astronomical market cap increase—nearly ninefold since the conclusion of 2022—the recent fluctuations in its stock prices signal a more precarious phase. In this article, we will analyze the implications of these developments, the factors driving Nvidia’s performance, and what future prospects may hold for both the company and its investors.

Nvidia has firmly established itself as a major player in the AI arena, fueled by demand for its graphics processing units (GPUs) that are indispensable for training artificial intelligence models. The company rode a wave of demand last year, briefly earning the title of the world’s most valuable publicly traded company. However, soon after reaching its peak in June, it faced a sharp decline, losing around 30% of its market value within a brief span of seven weeks—representing a staggering decrease of approximately $800 billion.

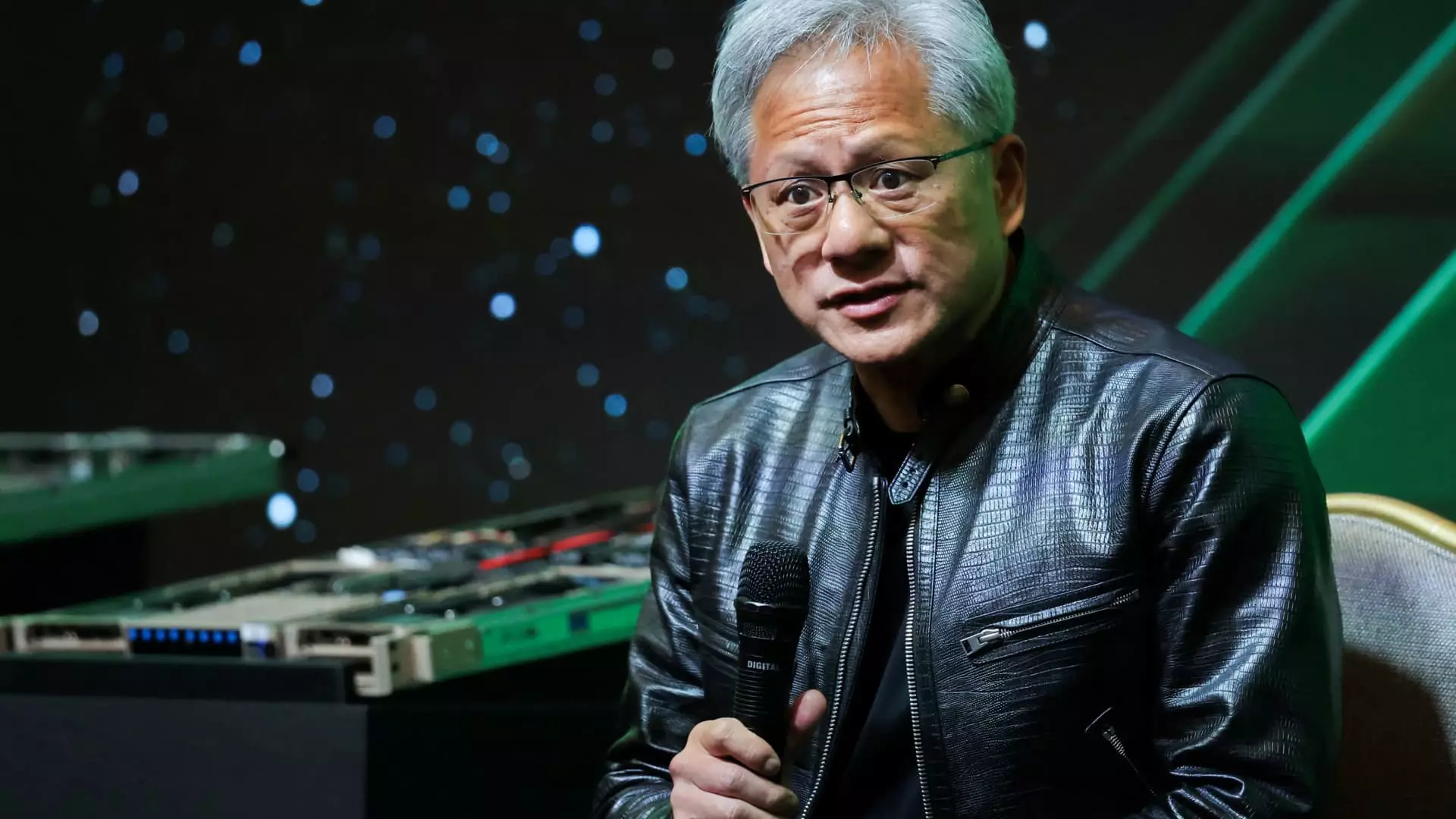

The significance of Nvidia’s stock is underscored by comments from market analysts, notably Eric Jackson from EMJ Capital, who regards it as a pivotal player in the market, stating, “It’s the most important stock in the world right now.” Indeed, the stakes are high: any signs of a downturn in AI demand could reverberate across the entire market. As Nvidia prepares to unveil its quarterly results, Wall Street’s attention will undoubtedly monitor closely whether the company continues its meteoric rise or whether it lays an “egg,” sending shockwaves through the market.

The company’s performance in upcoming earnings is particularly pivotal as its peers, comprising some of the largest tech giants like Microsoft, Alphabet, and Amazon, have also been vocal about their reliance on Nvidia’s offerings to power their AI ambitions. Recent earnings calls highlighted the depth of investment in Nvidia’s GPUs with revenue more than tripling year-on-year, primarily driven by growth in its data center business—a segment responsible for a substantial portion of Nvidia’s earnings.

Analysts are keenly anticipating Nvidia’s fourth consecutive quarter of triple-digit growth, albeit with an expected reduction, projecting revenues of around $28.7 billion. The landscape, however, is evolving; year-over-year comparisons will soon become increasingly challenging, with forecasts predicting a slowdown over the next six quarters. Investors will remain fixated on Nvidia’s predicted outcomes for the upcoming October quarter, with expectations of around 75% growth to $31.7 billion—a figure that embodies both optimism and vulnerability.

The forecast becomes crucial as it would signal clients’ appetites for further investments in AI infrastructures. Recent discussions from industry leaders, including Google and Meta, echoed sentiments about the necessity of aggressive spending to keep pace with technological advancements. High-profile claims from former Google CEO Eric Schmidt emphasize the looming need for capital in the range of billions—indicative of the strenuous necessity for processors and related AI technology.

Despite the impressive profit margins that Nvidia has been experiencing, questions linger about the tangible long-term return on investment for clients committing large sums to GPU expenditures. This uncertainty is particularly relevant for cloud service providers, responsible for a significant share of Nvidia’s revenue, who will face increasing scrutiny about the returns on their substantial investments. The company’s previous earnings calls have hinted at potential metrics to gauge performance, promising more insights in subsequent sessions that could bolster confidence amongst investors.

Nvidia’s innovations are pivotal to its sustained market dominance. The upcoming Blackwell chips are highly anticipated; however, reports of production challenges have marred expectations, potentially deferring shipments until early 2025. While current-generation chips (Hopper) have positioned Nvidia well for meeting immediate market needs, the pressure of competition from rivals such as AMD and Google looms, necessitating a swift transition to maintain leadership.

Analysts appear cautiously optimistic about how timing adjustments for the anticipated chips could affect Nvidia’s bottom line, seeing potential revenue delays rather than losses. Strong demand for existing Hopper products could mitigate any adverse impact of Blackwell’s delay as customers are compelled to secure computational power for next-generation AI applications.

Nvidia stands at a pivotal crossroads, heavily influenced by macroeconomic sentiment, client investment strategies, and its own production capacities. The rollercoaster ride for investors emphasizes the fragility and excitement that accompany technological leaders navigating an increasingly competitive and rapidly evolving AI landscape. As Nvidia progresses towards its upcoming earnings announcement, investors may find themselves walking the line between optimism and apprehension while reflecting on a future laden with both opportunities and challenges.