MongoDB shares experienced a significant surge of up to 16% in after-hours trading following the release of the company’s healthy fiscal second-quarter earnings report. The database software maker exceeded LSEG consensus expectations with an adjusted earnings per share of 70 cents compared to the anticipated 49 cents. Additionally, MongoDB reported revenue of $478.1 million, surpassing the expected $464.1 million. The company’s revenue saw a 13% year-over-year growth in the quarter ending July 31, indicating positive performance.

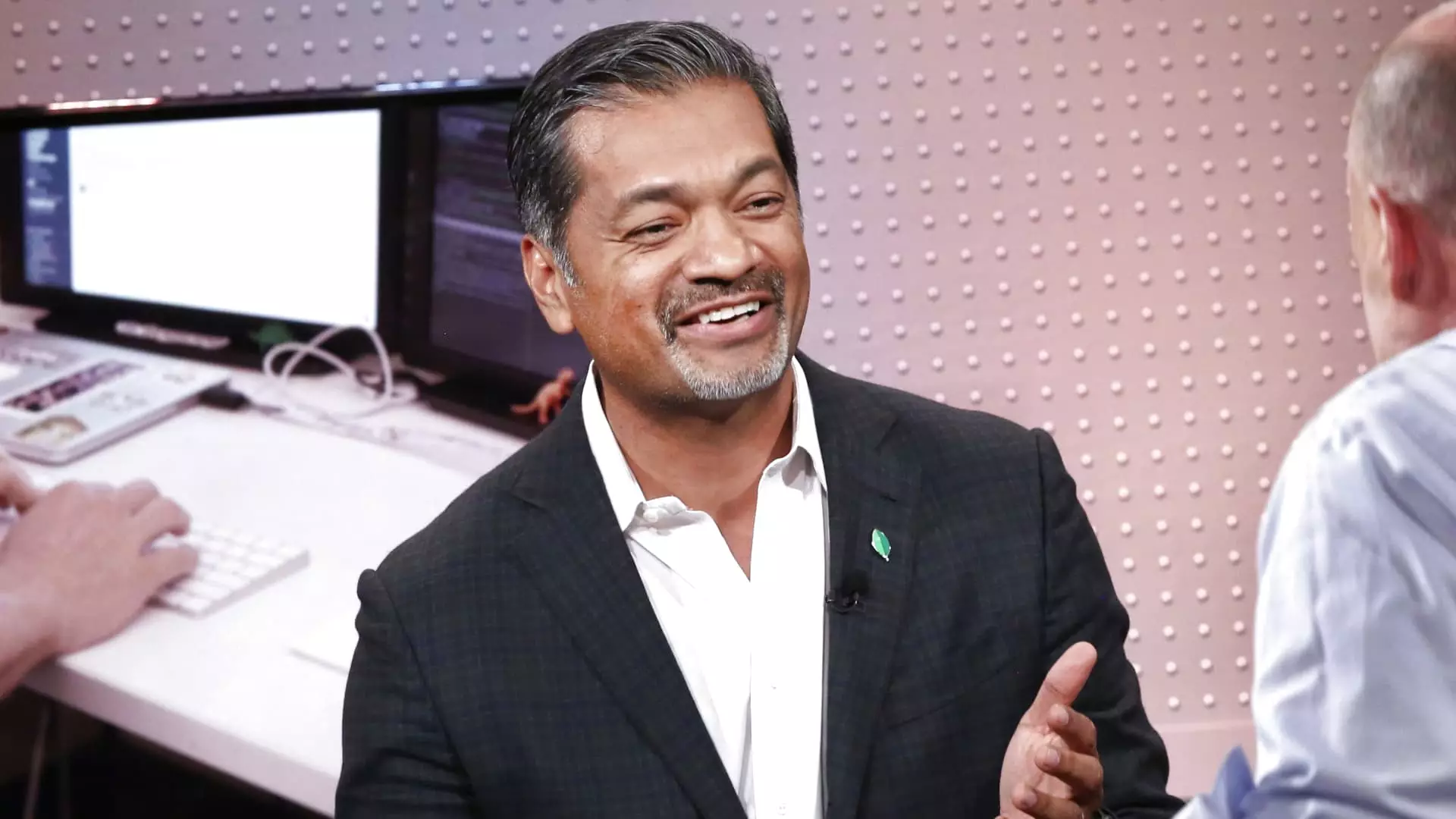

CEO Dev Ittycheria expressed optimism about MongoDB’s position in the market, stating that the company is well-equipped to assist customers in integrating generative AI into their operations and modernizing their legacy application estate. Despite challenges in the macroeconomic environment, Ittycheria highlighted MongoDB’s ability to continue winning new business in the second quarter. The CEO also emphasized the company’s Atlas cloud database service, noting that consumption exceeded expectations.

MongoDB’s outlook for the fiscal third quarter includes projected adjusted earnings of 65 to 68 cents per share on revenue ranging from $493.0 million to $497.0 million. This forecast surpassed analysts’ expectations of 60 cents per share in adjusted earnings and $478.8 million in revenue. Furthermore, the company raised its fiscal 2025 forecast to $2.33 to $2.47 per share in adjusted earnings, with anticipated revenue of $1.92 billion to $1.93 billion. These figures represent an increase from the previous guidance provided in May, reflecting MongoDB’s confidence in its future performance.

Market Comparison

In contrast to MongoDB’s positive trajectory, search software maker Elastic experienced a decline in stock value after reporting below-plan client commitments in its fiscal first quarter. The market response to Elastic’s performance resulted in a 23% drop in stock value after hours. CEO Ash Kulkarni mentioned a slowdown in client commitments, highlighting the importance of client acquisition and retention in the competitive landscape of software companies. MongoDB’s strategy to assist companies in migrating from Elastic products suggests a proactive approach to capitalize on market opportunities and expand its customer base.

Despite the fluctuations in share price and market conditions, MongoDB remains focused on innovation and customer-centric solutions. The company’s commitment to enhancing its offerings and supporting clients through digital transformation initiatives positions it as a key player in the database software industry. MongoDB’s ability to adapt to changing market dynamics and deliver strong financial results underscores its resilience and long-term growth prospects. As the company continues to evolve and expand its market presence, investors and analysts will closely monitor its performance and strategic decisions in the competitive tech landscape.

MongoDB’s recent earnings report and revised guidance demonstrate its ability to navigate challenges and leverage opportunities in the market. The company’s leadership, commitment to innovation, and customer-focused approach contribute to its resilience and growth potential in the dynamic software industry.