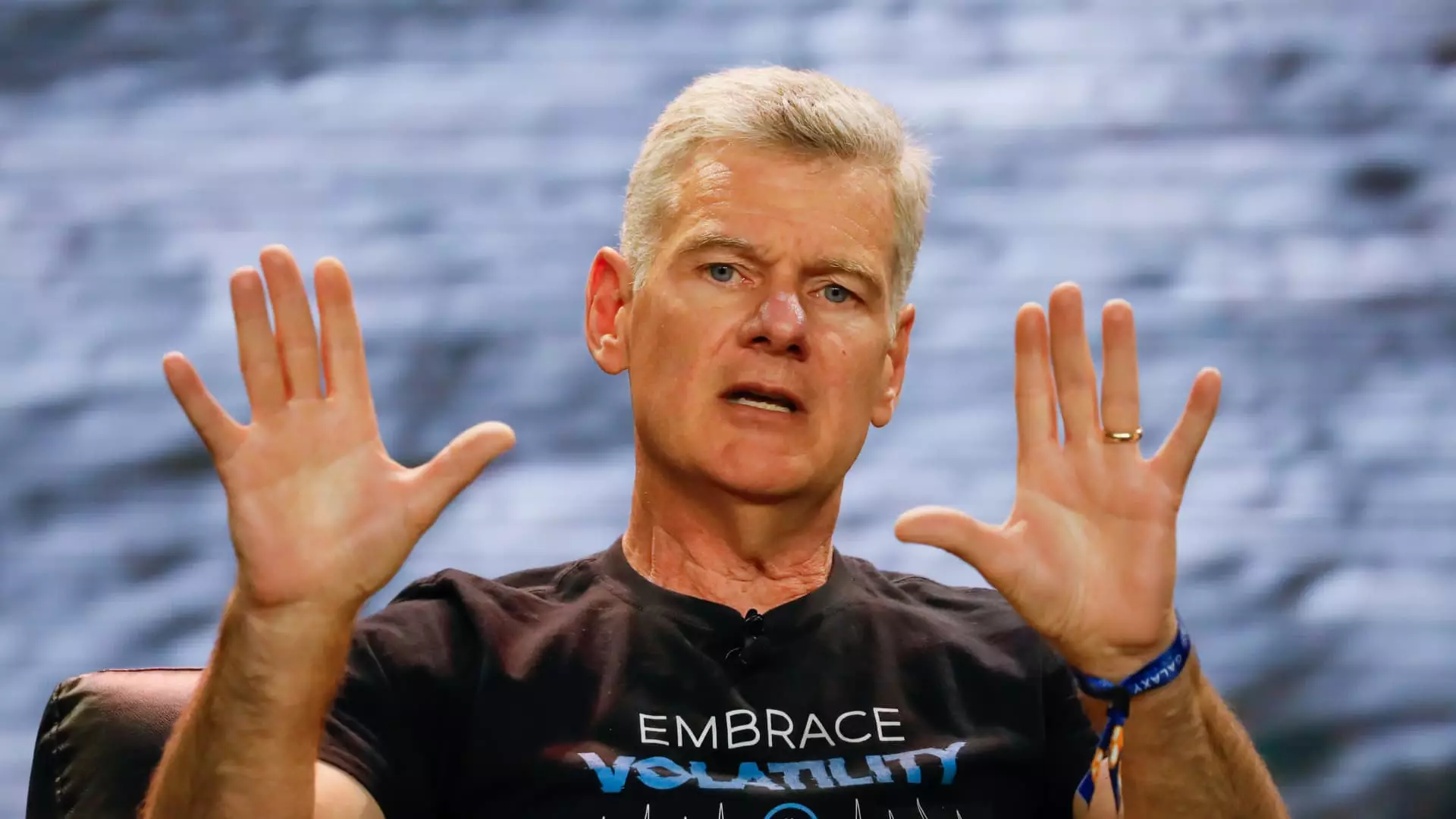

Renowned hedge fund manager Mark Yusko has made a bold prediction regarding the future of bitcoin, suggesting that the leading cryptocurrency could more than double in value this year, reaching an impressive $150,000. Yusko, who serves as the CEO and chief investment officer of Morgan Creek Capital Management, believes that investors should seriously consider adding bitcoin to their portfolios, recommending an allocation of between 1% to 3%.

In Yusko’s view, bitcoin reigns supreme in the world of digital assets, describing it as the dominant token and a superior alternative to gold. Pointing out the significant increase of around 159% in bitcoin’s value over the past year, Yusko remains optimistic about its potential for further growth. Despite a slight dip from its peak earlier in March, bitcoin continues to hold strong around the $70,700 mark.

Yusko attributes the positive outlook for bitcoin to several key factors, including the recent launch of bitcoin exchange-traded funds (ETFs) in January. He anticipates that the upcoming bitcoin halving, scheduled for late April, will create a supply shock that could lead to a new wave of bullish momentum for the cryptocurrency. The halving process involves cutting the rewards for bitcoin miners in half to control the coin’s supply, historically resulting in price surges.

According to Yusko’s analysis, the most significant price movements for bitcoin usually occur post-halving, with the value of the cryptocurrency becoming increasingly parabolic towards the end of the year. He predicts that, based on historical patterns, bitcoin could potentially peak around Thanksgiving or Christmas before entering a new bear market cycle. Yusko’s firm has also invested in Coinbase, a leading online trading platform for cryptocurrencies, expecting significant growth in the company’s value.

As bitcoin continues to display resilience and upward momentum, Yusko’s predictions offer a glimpse into the future of digital assets and the evolving landscape of cryptocurrency investments. With the growing mainstream acceptance and adoption of bitcoin, investors are becoming increasingly drawn to the potential returns and benefits that this innovative digital currency has to offer. As the market dynamics shift and new developments emerge, the stage is set for a potentially transformative journey for bitcoin and the broader cryptocurrency ecosystem.