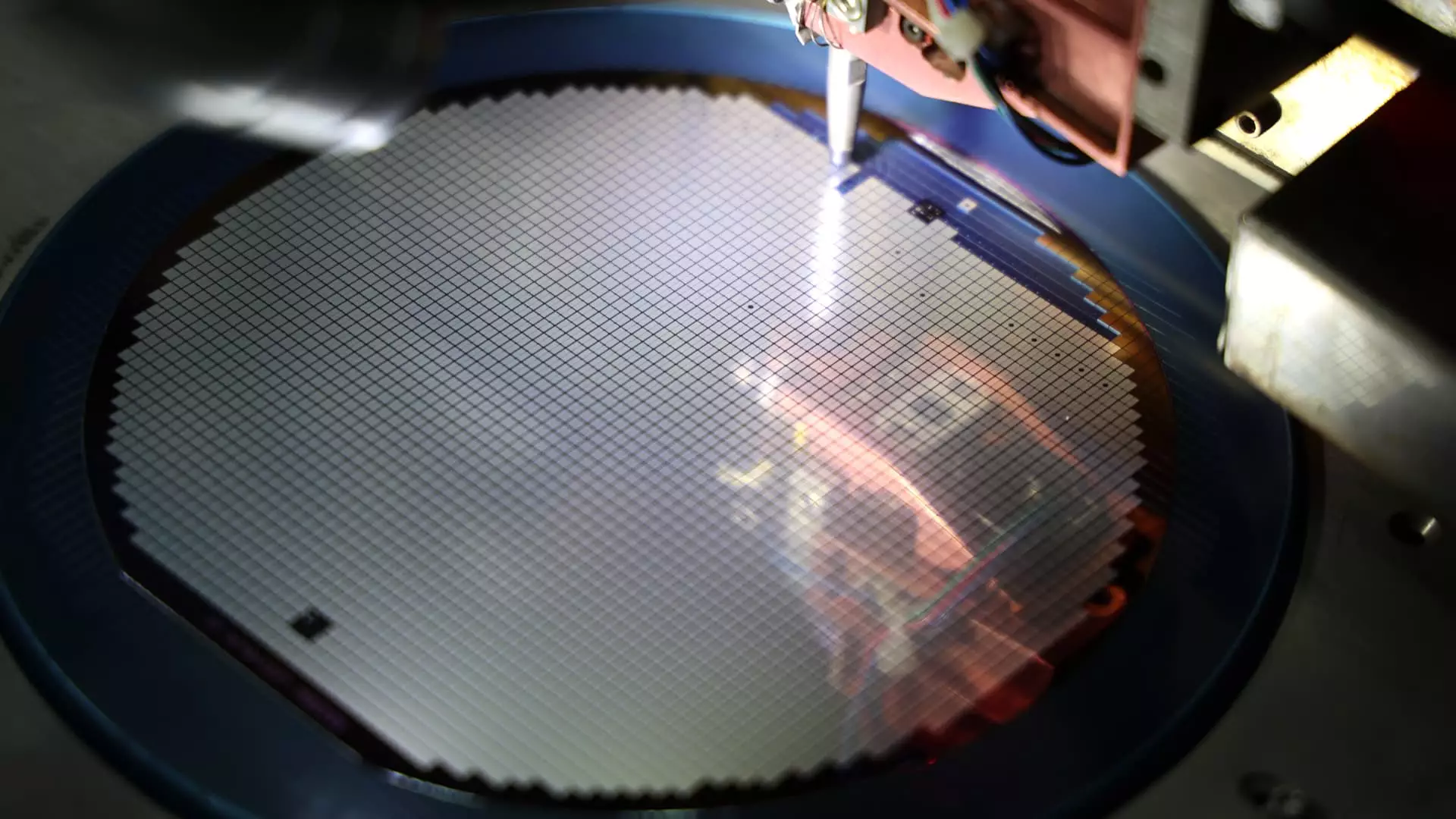

In a recent report by Bank of America analysts, it was noted that four of the world’s largest semiconductor equipment manufacturers, including ASML, have experienced a significant increase in their China revenue. Since late 2022, their share of revenue from China has more than doubled. This surge in revenue can be attributed to China’s decision to accelerate the purchase of semiconductor manufacturing equipment following tighter export restrictions imposed by the U.S. in October 2022. The companies analyzed in the report were Lam Research, ASML, KLA Corp, and Applied Materials, all of which saw their China revenue increase from 17% of total revenue in Q4 of 2022 to 41% in Q1 of 2024.

The report highlighted that technology, particularly the semiconductor industry, is at the forefront of trade tensions between the U.S. and China. With the potential for tensions to escalate further, companies in this sector could face increased risks. This was evident in October 2022 when the U.S. implemented strict export controls on the sale of advanced semiconductors and related manufacturing equipment to China. Recent reports have indicated that the Biden administration is considering expanding these restrictions to include non-U.S. companies, further complicating the landscape for semiconductorindustry players.

On the other hand, Beijing has been actively working to enhance its technological self-sufficiency, as evidenced by recent discussions at a key policy meeting. The Chinese government’s focus on developing its own semiconductor manufacturing capabilities aligns with its broader strategy to reduce dependence on foreign technology. This push for tech self-sufficiency has led to increased investments in domestic semiconductor equipment, contributing to the growth in revenue for foreign manufacturers operating in China.

Despite the uncertainties surrounding trade tensions and export controls, the VanEck Semiconductor ETF (SMH), which tracks U.S.-listed chip companies, has maintained significant gains for the year so far. While the ETF experienced a decline in the last week, it is still holding onto a substantial 46% increase in value. This resilience in market performance reflects the strong demand for semiconductor products globally, driven by emerging technologies such as 5G, artificial intelligence, and Internet of Things (IoT).

The rise of semiconductor equipment manufacturers in China underscores the complex interplay between geopolitics, trade dynamics, and technological innovation in the semiconductor industry. As companies navigate through these challenges, strategic partnerships, investments in research and development, and a deep understanding of the regulatory landscape will be crucial for sustainable growth and competitiveness in the rapidly evolving semiconductor marketholospowered by new technologies and shifting market demands.