In the semiconductor industry, the demand for talent is ever-increasing, with the competition for skilled workers intensifying. The industry is projected to face a significant shortfall of as much as one million workers in the U.S. economy by 2030. This shortage is fueled by the application of generative artificial intelligence, which further heightens the demand for competent technicians, computer scientists, and engineers. A study from the Semiconductor Industry Association highlighted that the U.S. chips industry alone is expected to experience a shortage of 67,000 professionals by 2030, exacerbating the broader talent crunch across various sectors.

To address the talent crunch and meet the escalating demands in the semiconductor industry, companies like GlobalFoundries are implementing innovative recruitment strategies. GlobalFoundries, one of the largest chipmakers globally, is actively seeking skilled candidates by tapping into various talent pools. The company has been focused on recruiting veteran candidates, individuals from its workforce reentry program, and women in construction initiative. By diversifying its recruitment efforts, GlobalFoundries aims to attract a diverse workforce capable of meeting the dynamic needs of the industry.

GlobalFoundries’ commitment to workforce development is evident in its initiatives to build a skilled talent pipeline. The company introduced the sector’s first registered apprenticeship program in 2021, offering full-time paid opportunities with benefits. This program, completed in two years or less, provides individuals with a high school diploma or equivalent the opportunity to receive training at no cost. By investing in programs like apprenticeships, GlobalFoundries is not only filling immediate roles but also nurturing talent for future positions within the company.

Creating opportunities for existing employees to grow and advance within the organization is crucial in retaining talent in the competitive semiconductor industry. Employees like Morgan Woods, who started as a technician and transitioned into a training and development analyst role, exemplify the potential for career advancement within GlobalFoundries. With a focus on compliance and training, Woods highlights the need for additional manpower to support the growing demand for microchips, particularly in sectors like automotive, where partnership with companies like General Motors necessitates highly skilled workers.

GlobalFoundries’ initiatives extend beyond professional growth to support employees’ financial well-being. Programs like the tax-free lifetime total of $28,500 toward student debt demonstrate the company’s commitment to alleviating financial burdens for employees. By offering benefits that address real-life concerns such as student debt, GlobalFoundries aims to enhance the overall financial stability of its workforce. This, in turn, enables employees like Woods to plan for future milestones such as homeownership and expanding their families.

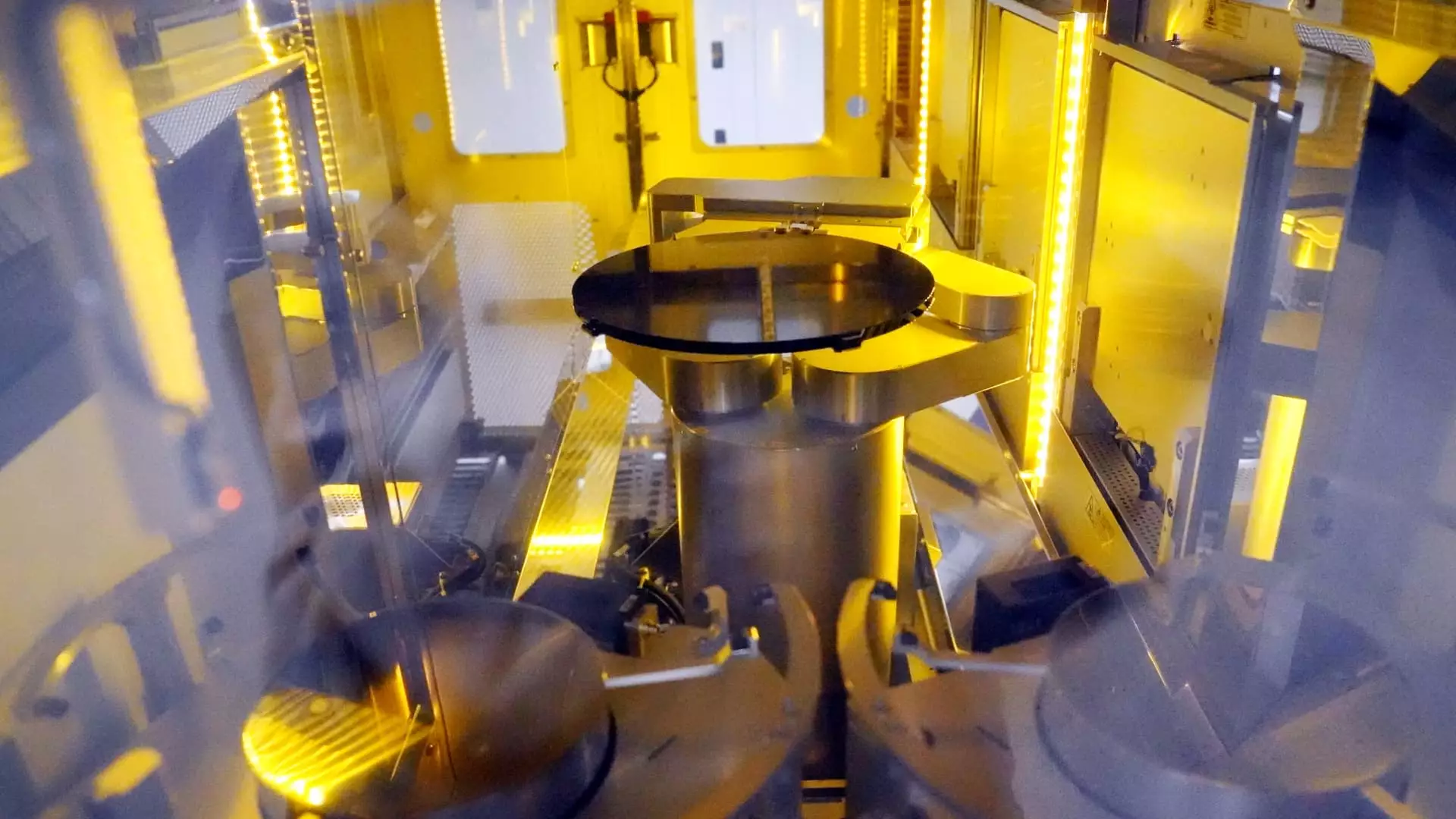

The CHIPS and Science Act’s funding will play a pivotal role in bolstering growth within the semiconductor industry. GlobalFoundries, with planned CHIPS funding of $1.5 billion, aims to expand manufacturing capacity in New York and Vermont, creating thousands of jobs in manufacturing and construction. By leveraging public and private investments, companies like GlobalFoundries can drive innovation, create employment opportunities, and strengthen the semiconductor ecosystem.

The semiconductor industry’s talent crunch presents both challenges and opportunities for companies like GlobalFoundries. By prioritizing workforce development, investing in employee growth, and leveraging government funding, semiconductor companies can navigate the evolving landscape of the industry. Through strategic recruitment, employee empowerment, and financial support, companies can build a resilient workforce capable of meeting the demands of the digital era.