Nvidia has been surfing the wave of explosive growth that AI and high-performance computing demand has generated. The surge in sales of their graphics processors is reminiscent of the gold rush—an electrifying moment where opportunity becomes potent and competition fierce. However, as Nvidia heads towards its earnings report, the landscape has shifted dramatically, casting a shadow over its previously unassailable position. This isn’t merely about quarterly figures; it’s a critical juncture that threatens to undermine Nvidia’s hard-won dominance, and it’s all underlined by geopolitical complexities surrounding its relationship with China.

The specter of restrictive regulations looms large over Nvidia as new export license requirements emerge. These are not standard restraints but are specifically directed at the H20 chip, a product essential for maintaining their competitiveness in the Chinese market. This may well be the first domino to fall in a series of regulatory upheavals that threaten to destabilize Nvidia’s growth model. The reality is harsh: a staggering $5.5 billion write-down on inventory sends shockwaves through the organization and signals a substantial impact on future revenue—a move analysts are calling unprecedented in the chip industry.

Market Share Erosion and the Rising Chinese Competition

To illustrate the gravity of the situation, we can look at the numbers. Once holding a commanding 95% market share of graphics processing units in China, Nvidia now faces strident challenges, with that figure sliced down to a meager 50%. The narrative is clear: reduced access to China not only jeopardizes Nvidia’s current sales but also incentivizes a burgeoning tech ecosystem within China, driving engineers to innovate and develop their own chips. Ironically, this restriction may backfire, further empowering the Chinese semiconductor industry while risking U.S. technological leadership.

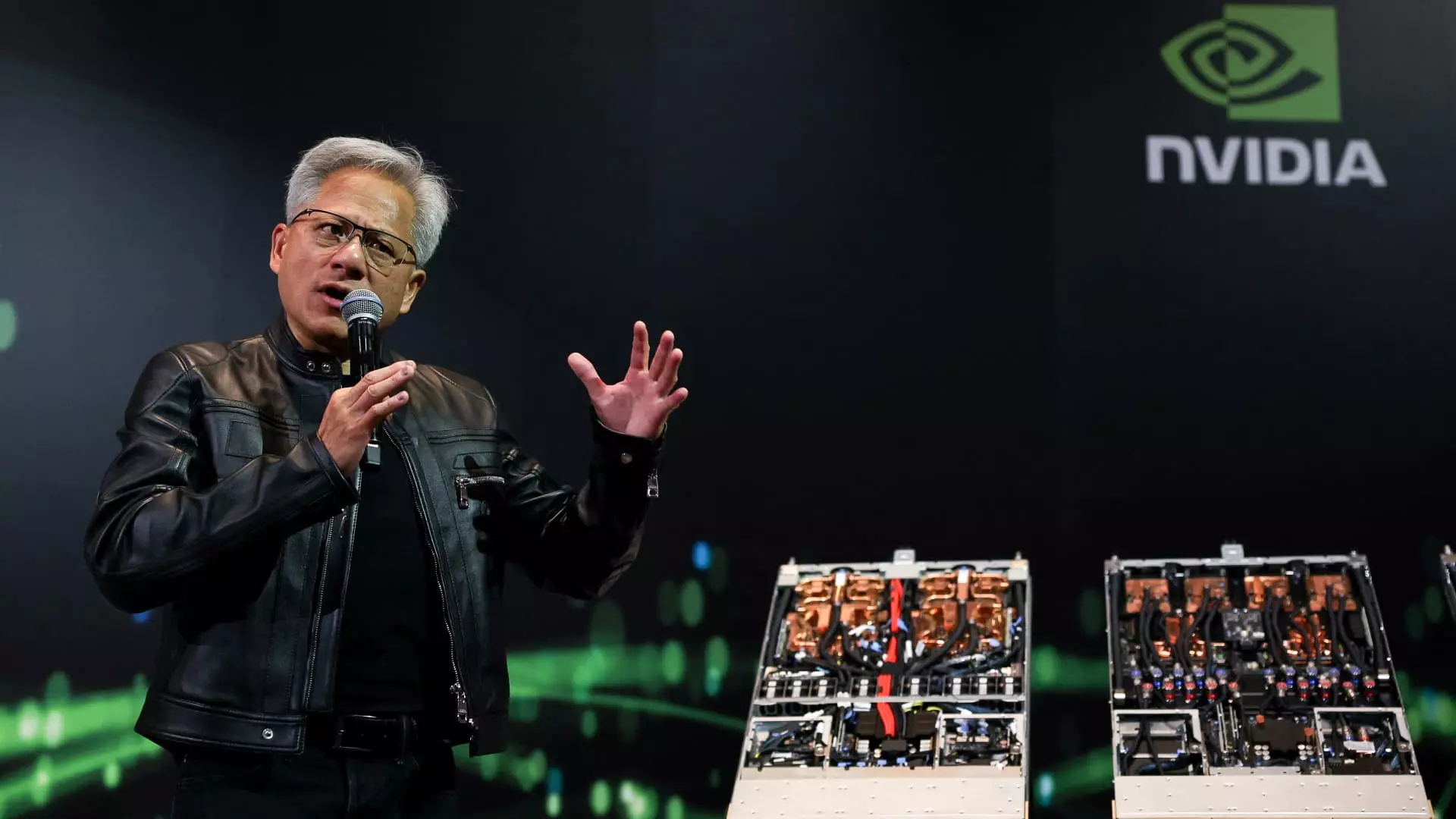

Nvidia’s CEO, Jensen Huang, stands at a critical crossroads, articulating fears that the U.S. government’s strategy will not only hurt Nvidia but lead to a self-sustaining Chinese technology sector. Indeed, the ostensible goal of these restrictions—to safeguard U.S. interests—could reverse itself, morphing into a catalyst for competition rather than a bulwark against it. The conditions are ripe for a tech cold war, where retaliation becomes inevitable, and resulting innovation in adversarial contexts could redefine the landscape altogether.

The Repercussions of Uncertainty

Analysts are bracing for mixed signals as Nvidia gears up for its earnings call. Predicted growth of 66% marks a significant slowdown from the eye-popping figures of previous quarters, where growth figures surpassed 250%. This deceleration is more than just numbers—it reflects a looming uncertainty that sends ripples through investor sentiment. Analysts are forecasting up to a $15 billion revenue hit affecting not only the current fiscal year but also creating an uncomfortable precedent for Nvidia’s market stability.

Equity markets react swiftly to such uncertainty. While Nvidia’s shares have shown resilience—currently up about 1% in 2025—this recovery obscures a deeper concern: the long-term sustainability of their growth trajectory amidst a kaleidoscope of regulatory challenges. The broader tech landscape, typified by a fighting spirit among other semiconductor giants like Advanced Micro Devices, indicates a contentious battle ahead. The question remains: can Nvidia maintain its lead, or will it become a cautionary tale of what happens when a company becomes too reliant on a singular market?

A Complicated Path Forward

Nvidia finds itself in a precarious position, lobbying for licenses that will permit the export of the H20 chip to China—a path fraught with uncertainty. The rescission of the previous “AI diffusion rule,” which placed stricter limitations on AI chip exports, may offer a glimmer of hope. However, the complexities surrounding the new regulatory framework leave many questions unanswered. What will be allowed, and how will the U.S. government continue to balance national security with economic interests?

Morgan Stanley analysts underscore the ambiguity of Nvidia’s situation, hinting at the idea that clarity won’t emerge in the immediate future, particularly during the forthcoming earnings call. The deeper narrative speaks to the fragile relationship between innovation, regulation, and global interdependence—a balancing act that many companies now find themselves undertaking under threat of disruption.

In this age of rapid technological advancement, a company’s ability to navigate the waters of regulation and market dynamics can define its legacy. Nvidia’s story may well be a cautionary tale, emblematic of the intricate dance between technological prowess and the geopolitical landscape in which it operates. What remains to be seen is whether Nvidia can adapt or whether it will remain a victim of circumstances beyond its control.