Warren Buffett, the esteemed CEO of Berkshire Hathaway, has made headlines once again by significantly reducing his stake in Apple Inc., marking the fourth consecutive quarter of a downward trend in this once-mighty investment. As of September’s end, Berkshire Hathaway reported that the value of its Apple shares stood at an impressive $69.9 billion, which intriguingly represents a dramatic 67.2% decrease from the previous year’s figures. Such substantial divestment—approximately a quarter of the holding—leaves Berkshire with around 300 million shares still within its portfolio. This shift has raised eyebrows across Wall Street and among avid investors who have tracked the firm’s love affair with the tech giant.

The Motivations Behind the Sales

Buffett began selling off portions of his Apple stake in the fourth quarter of 2022, with more aggressive selling taking place in the mid-2023 period when he surprisingly offloaded nearly half of this significant investment. While some analysts speculate that rising valuations led him to reconsider his position, others suggest that this strategy is part of a broader portfolio management effort aimed at mitigating concentration risk. At one point, Apple represented an overwhelming 50% of Berkshire’s equity, making it a crucial—but potentially vulnerable—component of the company’s investment strategy.

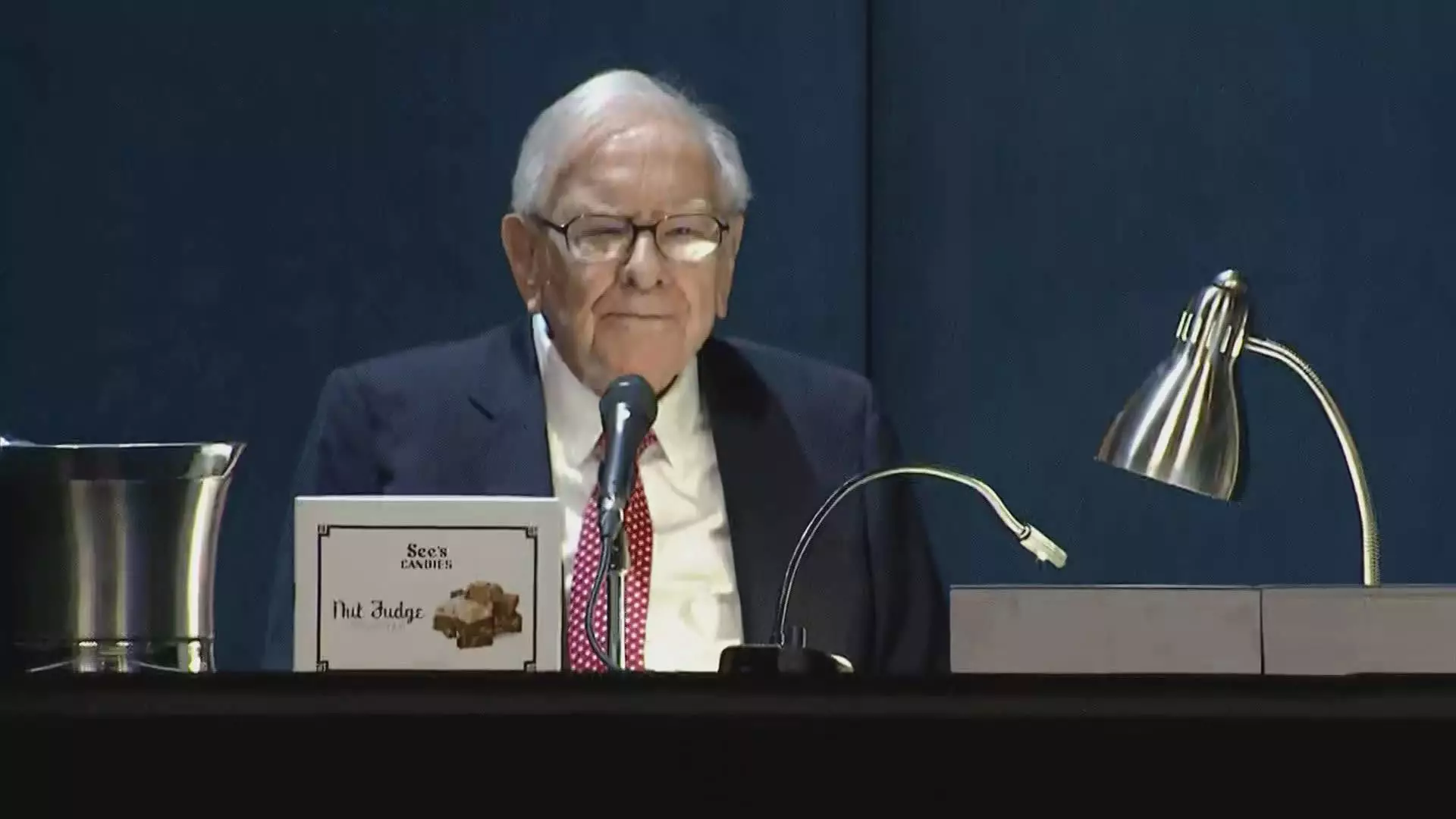

During the annual meeting of Berkshire in May, Buffett offered a glimpse of possible reasoning behind the divestment, hinting that impending tax increases on capital gains might drive further sell-offs. This rationale, however, seems inadequate when considering the sheer volume of stocks he has relinquished; many observers are beginning to wonder if greater financial strategies are at play.

Historically, Buffett has been skeptical about investing in technology stocks, frequently stating that they lay outside his so-called “circle of competence.” His foray into tech began with Apple in 2016, largely driven by his investment managers, Ted Weschler and Todd Combs. The adoration for Apple stemmed from its robust customer loyalty and the overarching ‘stickiness’ of its flagship product, the iPhone, which made it an attractive investment. Over time, Buffett elevated Apple to the level of significance he ascribes to his core insurance holdings, dubbing it one of the most pivotal businesses in his portfolio.

Intriguingly, amid these significant divestments, Berkshire Hathaway has seen its cash reserves swell to a staggering $325.2 billion—an all-time high for the conglomerate. Such liquidity positions the company well for future investments or acquisitions, but it also raises the question of whether Buffett might be steering towards greater diversification. Notably, the company has paused its buyback initiatives during this quarter, suggesting a more cautious approach to capital allocation.

In light of all this, Apple shares have exhibited a relatively robust performance, boasting a 16% increase year-to-date, albeit lagging slightly behind the S&P 500’s impressive 20% gain. The overall market environment, coupled with Buffett’s recent actions, constantly prompts speculation about whether he is maneuvering for a long-term strategy or making decisions driven by immediate financial imperatives.

While Buffett’s actions have stirred a whirlwind of analysis, the underlying factors fueling these decisions remain multifaceted—indicating a potential shift in investment philosophy as Berkshire Hathaway continues to navigate an evolving economic landscape.